Electric cars versus engines: Why the best supply chain wins

Volvo Cars CEO Jim Rowan thinks those questioning EV economics have overlooked one big cost advantage that could determine carmakers’ future.

Much is made of the price premium attached to electric vehicles versus their petrol and diesel equivalents. But Volvo Cars global boss Jim Rowan thinks that will change sooner than some expect.

Rowan last year predicted price parity between internal combustion engine (ICE) vehicles and pure electrics by 2025 with that “inflection point” then significantly accelerating EV adoption.

Speaking with analysts this month, Rowan suggested electric vehicle propulsion supply chains are far more efficient than their ICE equivalents. That means carmakers investing to get ahead of the curve can then invest in advanced technologies to make their cars better, smarter and safer.

Which is what Volvo has been doing since 2021, when it divested the part of the business that makes internal combustion engines to form Aurobay.

Manufacturers trying to simultaneously make both engines and invest in new electric vehicles, however, face two sets of costs.

“We’ve done it. We are focused totally on that electric future in terms of our investment profile. A lot of our competitors are going to have to go through that Gordian knot at some point in time.”

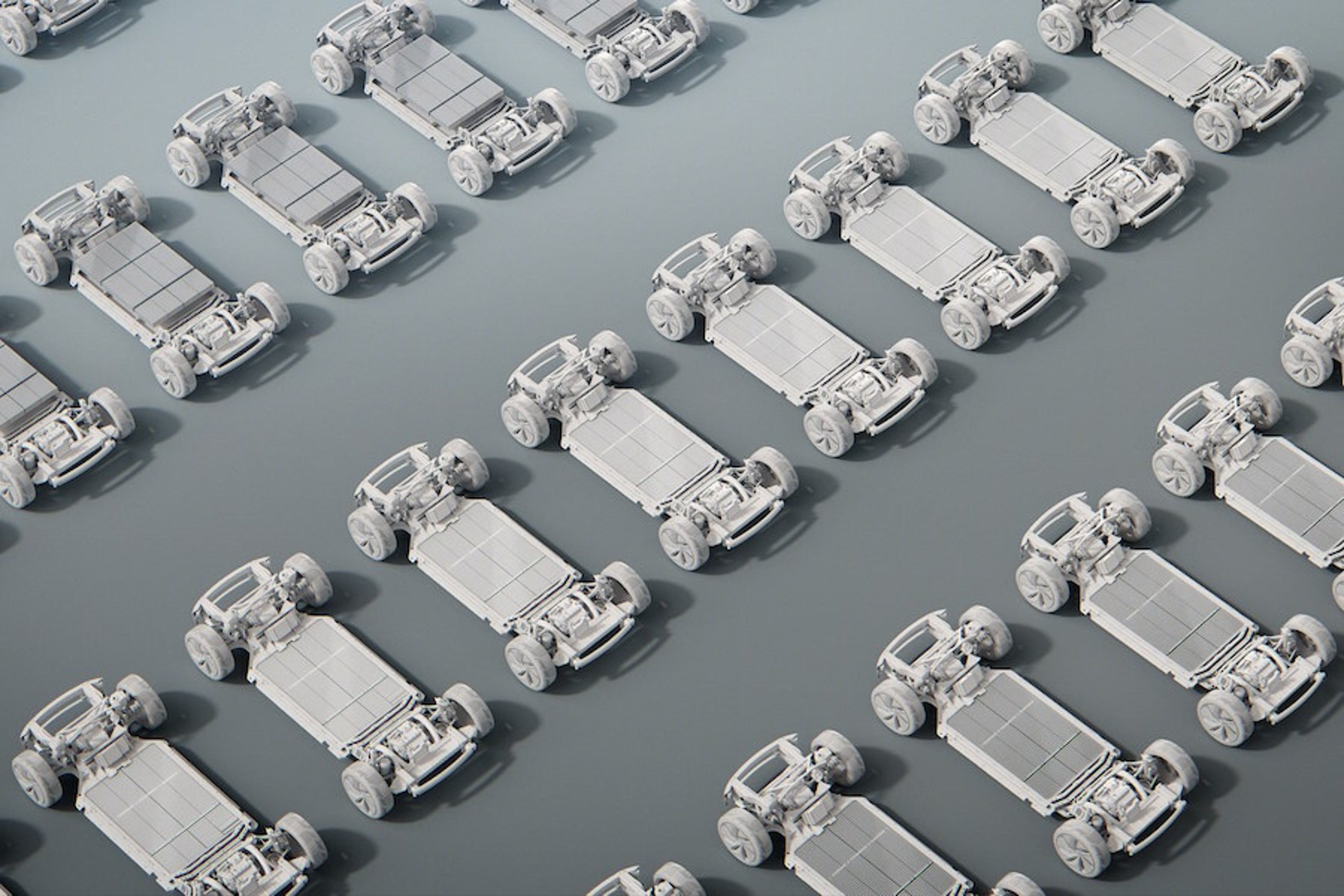

**The nuts and bolts of it**

Asked about the complexities of supply chain management between pure electrics and ICE cars, Rowan, who did his masters degree in supply chain and logistics, said that question does not get asked enough given the financial implications for carmakers.

“If you are doing an ICE car model [with] a 1.2 litre engine, a 1.6 litre engine, a 2 litre and 2.5 litre engine – every single component almost in those different engines is different. There are different sized cylinders, different cylinder head gaskets, there’s different nuts, bolts, washers and they are all machined parts. You’ve got roughly 2,500 separate components in an ICE engine – and you have to do [different] ones for a 1.2 litre, 1.6 litre, 2.0 litre and a 2.5 litre,” said Rowan.

“That means you have a tremendous amount of machining that you need to do, so you build all of these factories that are doing machined parts. A lot of those have got high capital intensity, a lot of them are highly unionised – and they are very difficult once you’ve made that investment to quickly change,” he added.

But electric vehicles have motors and batteries instead of engines – and no engines means no engine components.

“So let’s look at electrical propulsion and take that same analogy. A 1.2 litre gets say 10 battery modules; a 1.6 gets 12 battery models, a 2 litre gets [more] – it’s the same battery supply chain, [so] you take away all of that complexity,” said Rowan.

“We still have access to our ICE engines [via Aurobay], but we don’t need to invest in that,” he added. Instead, “we’re investing in all the new technologies of core compute and LIDAR that takes us forward. A lot of our competitors have got 20, 30 factories around the world, a lot of those in high cost geographies. They have these assets that they need to keep investing in – and they are all machined parts.”

Given investment analysts’ laser-like focus on cost and margins, Rowan suggested supply chain efficiency is perhaps overlooked.

“It’s a great question and I’m really surprised that narrative around electrification versus ICE doesn’t come to the fore a lot more,” he said.

“We’ve done it. We are focused totally on that electric future in terms of our investment profile. A lot of our competitors are going to have to go through that Gordian knot at some point in time.”

The analyst call also covers:

– When the flagship EX90 will enter production, “we’re on track to start manufacturing in Q2”, per Rowan.

– Whether Volvo will produce a pure electric version of its best selling XC60, “natural at some point in time, we’re just not quite ready to announce that,” was the response.

– If Volvo will update its ICE models with facelifts, with Chief Commercial Officer Björn Annwall indicating it will.

– Whether Volvo will release an EV Wagon, a question Jim Rowan has previously posed, which was neither confirmed, nor denied.

Watch the full year earnings Q&A here.